Litigation History

Each and every claim needs close attention, no matter how small. Below is a list of some

of the cases CDA has successfully managed. To see a more extensive list, check out

our Litigation History PDF.

Georgia – Sabarin v. Liberty Convalescence, Inc.

This claim arose from a rear-end motor vehicle collision in Griffin, Georgia. The defendant driver struck the plaintiff on the passenger side rear. At trial, the defendant stipulated to liability but argued that this accident did not cause any injuries. The jury ultimately found a verdict in favor of the defendant. The evidence presented at the trial was that it was a moderate-impact collision that was unlikely to cause significant injuries. As a result, the jury found that based on the evidence presented the plaintiff did not prove that the accident caused any injuries and awarded her $0. Prime was able to obtain a defense verdict by keeping its insured updated and informed about the case and proactively managing the litigation.

Florida – Erich Bell v. CWC Transportation LLC & Fishnik Hasaj

This case involved a low-impact collision in a parking lot. Our insured was parked at a gas station when plaintiff pulled up to a gas pump and stopped with a trailer attached to his pickup. The plaintiff was seated inside of his vehicle and claimed numerous injuries from this accident, including herniated discs in his neck. Ultimately, the jury determined that our insured’s driver was only 35% at fault, while the plaintiff was 65% at fault. Applying those percentages to the verdict, the returned a verdict of only $23,365.25. As a result of Prime and our insured’s united defense against this plaintiff, we were able to get a great result at trial for our insured.

Virginia – Nimat Naderi v. Dricky Transport, Inc and Fredrick Boddle

Pedestrian crossing the street in a crosswalk, when our driver was backing a vehicle. Plaintiff sought $90,000 for injuries and $29,000 in lost wages. The Insured adamantly wanted to defend the case, which went to trial. We argued, Phillips v. Stewart, 207 Va. 214, 218, 148 S.E.2d. 784 (1966) a pedestrian is “not entitled arbitrarily to assert their right of way crossing in the face of traffic dangerously close to him.” The judge ruled that there was no cause, in favor of defense and awarded the Plaintiff $0.

Florida/Utah – Insurance Partners – Dismissed Claims

CDA was managing a claim on which both Prime Insurance Company (“Prime”) and Beazley Group (“Beazley”) were insurers. Beazley ignored CDA and Prime’s recommendations regarding the best defense strategy and they settled the claim for $6.5 million. Beazley then attempted to blame CDA and Prime for its poor decision and demanded that Prime and CDA repay them. Prime and CDA refused. Litigation ensued. Beazley’s efforts to forum-shop its claims were denied twice, with a Florida Court of Appeals affirming the district court’s ruling that Beazley’s actions against Prime and CDA were “wasteful.” Shortly thereafter, the Utah court granted Prime’s motion for full summary judgment, dismissing all of Beazley’s claims.

Connecticut – Zipline – Defense Verdict

Plaintiff alleged neurological injuries after riding the defendant’s drop zipline while attending their water park. The evidence presented at trial showed that the drop zip line was not inherently dangerous, and the plaintiff did not follow the verbal directions or directions posted by the ride. After a two-week trial, the jury deliberated for less than 3 hours and came back with a defense verdict.

Florida – Trucking – Defense Verdict

Plaintiff alleged that the insured’s trailer swerved into his lane, struck his vehicle which caused him to crash into the guardrail. Prior to trial, the plaintiff demanded $75,000 to settle the case. We did not make an offer. At trial, the evidence showed that the plaintiff did in-fact cause the accident. The jury came back with a defense verdict.

Texas – Night Club – Reversed verdict

Claim was made against our insured due to the death of a woman in a vehicle that was hit head on by a man (the “allegedly intoxicated person” or “AIP”) alleged to have been overserved while drinking there. The appellate court ruled that our insured did not violate the Safe Harbor provision of Texas dram shop laws and reversed the verdict, granting a judgment in favor of our insured and awarding us the costs incurred in filing the appeal.

Colorado – Towing – Judgment in favor of defendant

The plaintiff alleged that defendant’s employees breached the peace while they were attempting to repossess her vehicle. The trial judge granted insured’s motion for directed verdict on all counts, entering a judgment in favor of the defendant and against the plaintiff, and dismissing the lawsuit, with prejudice.

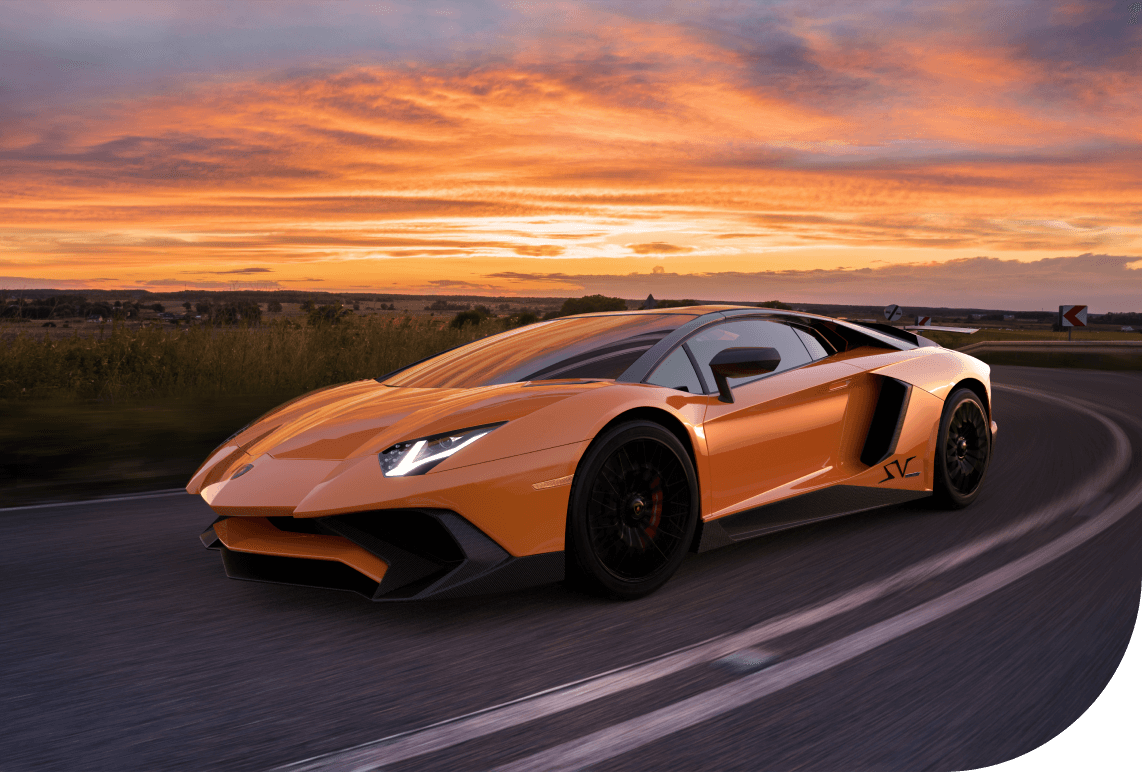

Exotic Car Rental – Obtained great results

An exotic car rental company insured by us was sued in a Wrongful Death action. Plaintiffs’ estate alleged that our insured was independently liable for Plaintiffs’ damages, based on a theory of negligent entrustment and/or supervision of the exotic luxury vehicle that they had rented to a customer. We partnered with our insured to fight, ultimately obtaining a great result.

Backcountry Skiing – Resolved Claim for Final Expenses

A backcountry skiing outfitter insured by Prime, Utah Mountain Adventures, Inc., was involved in an avalanche where one of the participants, Doug Green, was killed. CDA was able to immediately assist by mitigating media pressure and diffusing what may have otherwise been a public relations nightmare. With the Insured’s help, CDA was also able to reach out to the family of the deceased person and resolve the claim for $30,000 – the approximate cost of funeral and travel expenses – even though the family had hired representation that had previously demanded a payment of 10 times that amount.

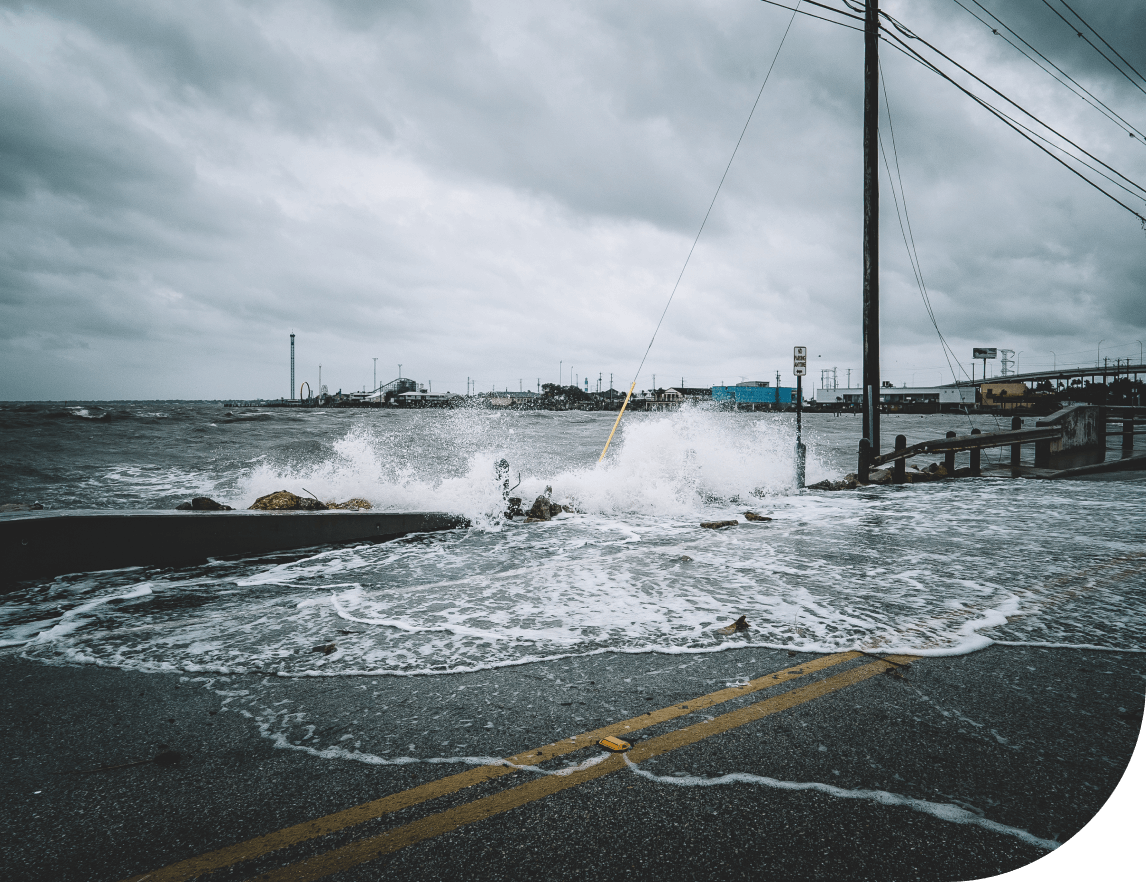

Mississippi – Hurricane – Defense Verdict (First jury verdict in MS for Hurricane Katrina)

One of our policyholders believed he was being treated unfairly by us in the aftermath of Hurricane Katrina. The jury unanimously agreed that we had been fair and rendered a defense verdict in our favor. This was the first jury verdict in Mississippi regarding Hurricane Katrina that was in favor of the insurance company.

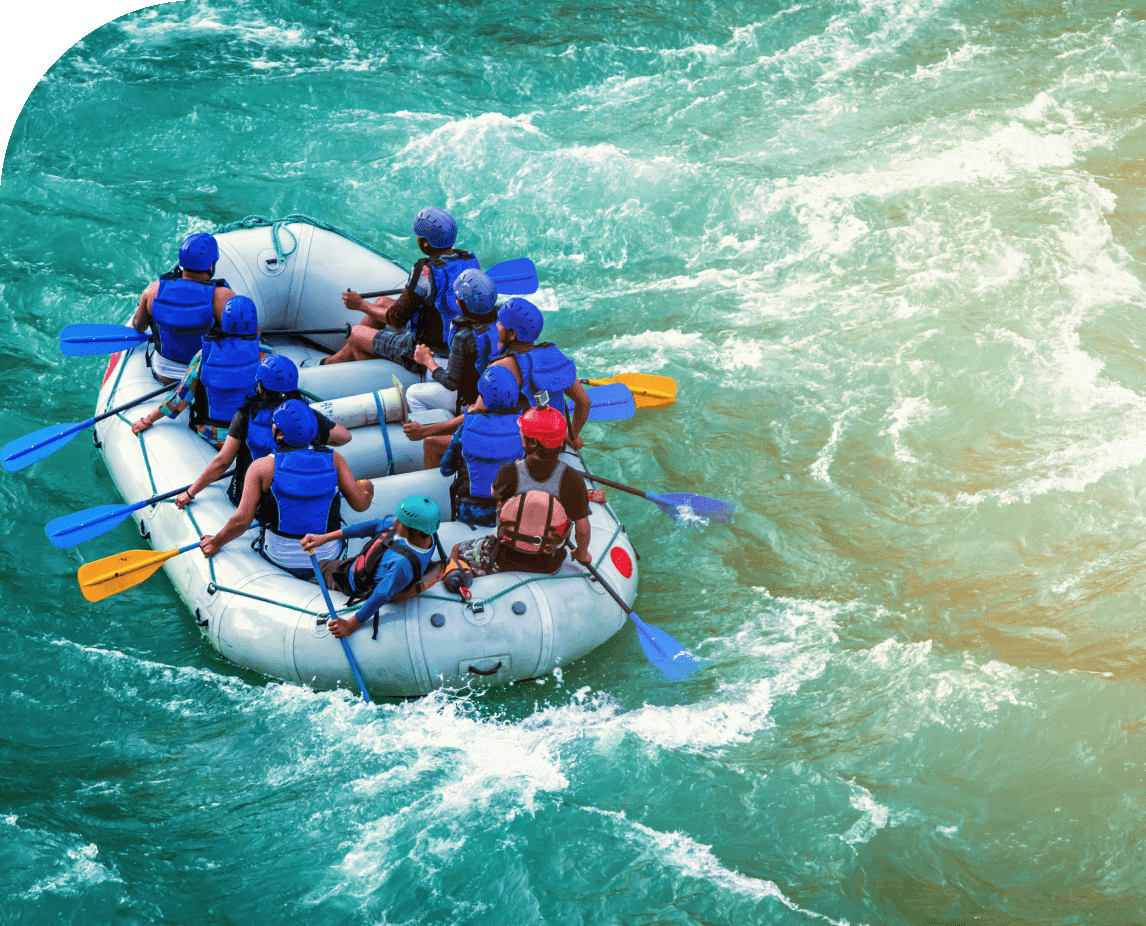

California – Whitewater Rafting – Court agreed and upheld liability waiver

The plaintiff had drowned while participating on a guided whitewater rafting trip offered by an insured. We defended our insured by arguing that the liability waiver form signed by the plaintiff barred his recovery. The court agreed with us and upheld the liability waiver. That determination was later upheld on appeal, creating new case law in California regarding the effectiveness of signed pre-accident liability waiver forms.